5 Simple Techniques For chapter 13 bankruptcy

You need to begin sending that cash in thirty days of your bankruptcy submitting, even when the court hasn't nevertheless signed off in your repayment program.

This prevents creditors from taking any action from you to gather in your debts — usually, they’re even prevented from contacting you any more, so no much more collector calls. All lawsuits and wage garnishments are stopped, as well.

Adequate time has handed due to the fact your previous submitting. You may not get a discharge in case you submitted for bankruptcy not long ago. You need to hold out two many years to file for Chapter thirteen and 4 a long time for those who filed for Chapter seven.

In Chapter 7, most unsecured debts like bank cards and medical bills are totally discharged. In Chapter thirteen, your debts may be partly or fully repaid with the required payment approach.

The filing starts off your bankruptcy situation. Before long soon after, the court clerk will send out a letter notifying you, the trustee appointed for your scenario, as well as your creditors of the automated stay prohibiting assortment actions.

With this, you’ll take out a financial debt consolidation personal loan and use it to repay your present financial loans and credit cards. Then, as an alternative to paying a number of personal debt payments, you’ll have only a person Invoice to pay for — your consolidation personal loan.

Debtor training class: Prior to the Chapter thirteen bankruptcy is comprehensive, you have to finish a “debtor training class” from a nonprofit credit history counseling agency.

Co-signers will not be held dependable legally. A bit of Chapter 13 regulation known as the “co-debtor continue to be” helps prevent creditors from heading soon after anyone who co-signed for you personally on the debt.

Take into find account bankruptcy In case your issue debts overall over forty% within your once-a-year cash flow or would just take 5 years or more to repay Even though you took Intense steps. Chapter 13 may very well be your best bankruptcy route if:

Every single article that we publish has click here for more been prepared or reviewed by among our editors, who together have more than a hundred years of working experience training regulation. We strive to maintain our info present-day as legislation improve. Find out more about our editorial specifications.

Chapter 13 bankruptcy provides debtors with their backs from the page wall some respiratory home. It stops collections, like foreclosures and repossessions. It would require you to repay some debts, anchor usually over three to 5 years.

Victoria Stoner Your condition is unique And that i am dedicated to offering individualized solutions on your authorized issues.

You have got to deliver evidence that you simply submitted your tax returns for the last four decades and every other info your trustee asks for.

The cut-off dates use provided that you count on to discharge some credit card debt, indicating you received’t have to repay it. You can file Chapter more helpful hints thirteen a lot more often, however, you can’t anticipate personal debt for being discharged unless you may have waited the expected time.

Anthony Michael Hall Then & Now!

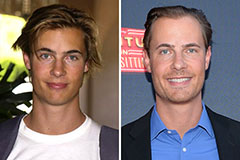

Anthony Michael Hall Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!